【Form 1040・Form 1040-SR・Form 1040-X】Which Tax Form Should You Use?

Filing your taxes can be daunting, especially when deciding which tax form to use. The IRS provides several forms tailored to different financial situations, and choosing the correct one is crucial for accurately reporting your income and claiming deductions. This guide will walk you through the most commonly used tax forms and help you determine which one fits your needs.

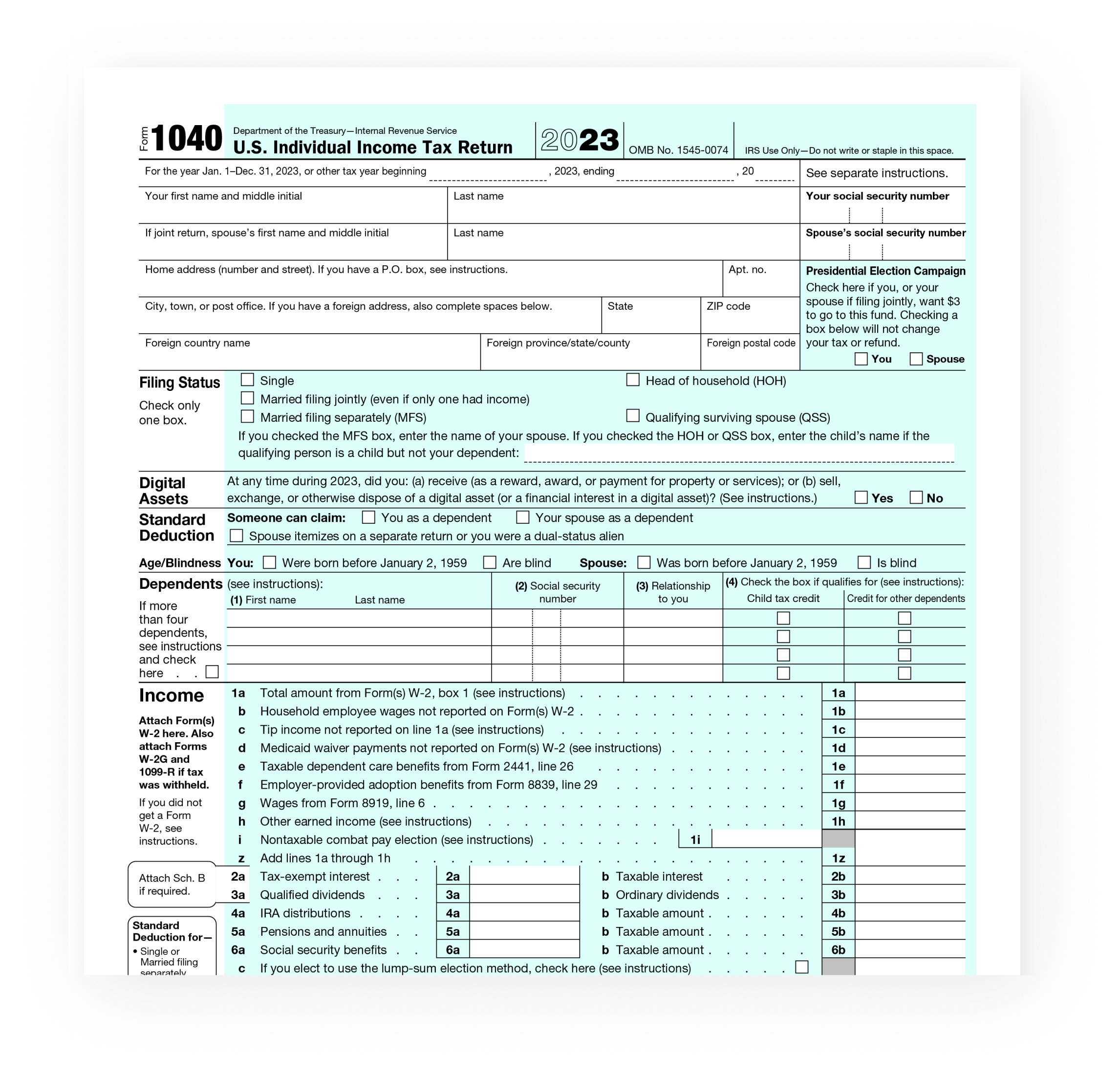

1. Form 1040: The Standard Form

Form 1040 is the most commonly used individual income tax form. It is versatile and accommodates various income levels, deductions, and credits.

Who Should Use Form 1040?

- Most individual taxpayers.

- People with income from wages, salaries, self-employment, investments, or rental properties.

- Those claiming itemized deductions or tax credits like the Child Tax Credit or Earned Income Tax Credit (EITC).

Key Features:

- Allows both standard and itemized deductions.

- Accommodates additional schedules for complex situations, such as business income (Schedule C) or capital gains (Schedule D).

2. Form 1040-SR: For Seniors

Form 1040-SR is designed for taxpayers aged 65 or older. It is similar to Form 1040 but has larger print and includes a standard deduction chart tailored for seniors.

Who Should Use Form 1040-SR?

- Taxpayers aged 65 or older.

- Those who prefer an easier-to-read form.

Key Features:

- Same capabilities as Form 1040.

- Special focus on retirement income, including Social Security benefits and distributions from retirement accounts.

3. Form 1040NR: For Non-Residents

Form 1040NR is for individuals who are not U.S. residents but earned income from U.S. sources. Non-residents typically have different tax obligations than residents.

Who Should Use Form 1040NR?

- Foreign nationals earning U.S.-sourced income.

- Students, scholars, or teachers under certain visa programs.

Key Features:

- Reports only U.S.-sourced income.

- Does not allow standard deductions (except for certain treaties).

4. Form 1040-X: Amended Tax Return

If you need to correct an error on a previously filed return, Form 1040-X is the appropriate choice. This form lets you amend information such as income, deductions, or credits.

Who Should Use Form 1040-X?

- Taxpayers who discovered errors after filing their original return.

- Those who need to claim additional deductions or credits.

Key Features:

- Used to update any previously filed Form 1040 series return.

- Requires submission of supporting documents for the changes.

5. Specialized Forms for Specific Situation

Some taxpayers may need additional or alternative forms depending on their financial circumstances:

- Form 1040-ES: For those making quarterly estimated tax payments (e.g., self-employed individuals).

- Form 1065: For partnerships reporting business income.

- Form 1120: For corporations filing corporate taxes.

How to Choose the Right Form

- Identify Your Income Sources:

- Are you an employee, self-employed, or receiving retirement income?

- Do you have foreign or investment income?

- Consider Your Filing Status:

- Single, Married Filing Jointly, Head of Household, etc.

- Evaluate Your Deductions:

- Are you taking the standard deduction, or do you have itemized deductions?

- Use IRS Resources:

- The IRS website and tools like the Interactive Tax Assistant can guide you in choosing the correct form.

Final Thoughts

Selecting the correct tax form is the first step in ensuring a smooth and accurate filing process. Understanding the differences between forms like 1040, 1040-SR, and 1040NR helps avoid errors and maximizes your deductions and credits. If you’re ever unsure, consider consulting a tax professional or using trusted tax software to guide you through the process.